What is an Employer Identification Number (EIN) and How to apply?

The modern American workplace is a bustling, complex network of employers of all sizes and industries. These businesses need a way to be identified, and that’s where the Employer Identification Number (EIN) comes in.

What is an Employer Identification Number (EIN)?

The EIN is a nine-digit number that identifies the business entity to the IRS or the equivalent governing body in your country. It is also referred to as a Federal Tax Identification Number (FTIN) or a Federal Employer Identification Number, but it is the same identification number applied across the board. The IRS has a list of all numbers and associated information. They will match you up with your account by name, address, and EIN when you file your tax return or report self-employment earnings. In every sense, this number is your identity as it relates to business activity in the United States.

What is the Difference Between Other Tax ID Numbers (SSN and ITIN)?

There are other tax id numbers that you may hear about in relation to doing business in the US. These include the Social Security Number (SSN) and the Individual Taxpayer Identification Number (ITIN).

1. Social Security Number (SSN)

The Social Security Administration issues the SSN to identify a person for social security purposes in the United States. It was initially designed to keep track of people drawing Social Security and their dependents, but it has grown and expanded into many other realms. The SSN is mandatory for obtaining jobs, bank accounts, credit cards, loans, mortgages, and government services. It is required on any official record, whether a marriage license, death certificate, or car registration.

2. Individual Taxpayer Identification Number (ITIN)

The ITIN is used for tax purposes for foreign citizens who earn money in the US but do not have an SSN. The IRS issues this number to non-citizens who are legally required to have an SSN but aren’t eligible based on their immigration status or if they don’t have enough income to meet the requirements. It acts as a substitute for the SSN for these individuals. You cannot use an ITIN to get a job, it is strictly for tax purposes, and you can only report income earned in the US with it.

Who Needs the Employer Identification Number?

Business entities such as limited liability companies (LLC), Corporations, and Partnerships are required to obtain Employer Identification Numbers (EIN).

If you employ someone to perform any job for you or make payroll, you need an EIN. This includes individuals, companies, corporations, LLCs, or associations that serve or intend to perform as job providers. Individuals may need to hire nannies, house managers, or other service providers. Companies may hire individuals to sell services or provide labor, even those hired temporarily. These can include independent contractors, consultants, and even attorneys. The IRS has a complete list of who needs to apply for one, and it can be found on the IRS website.

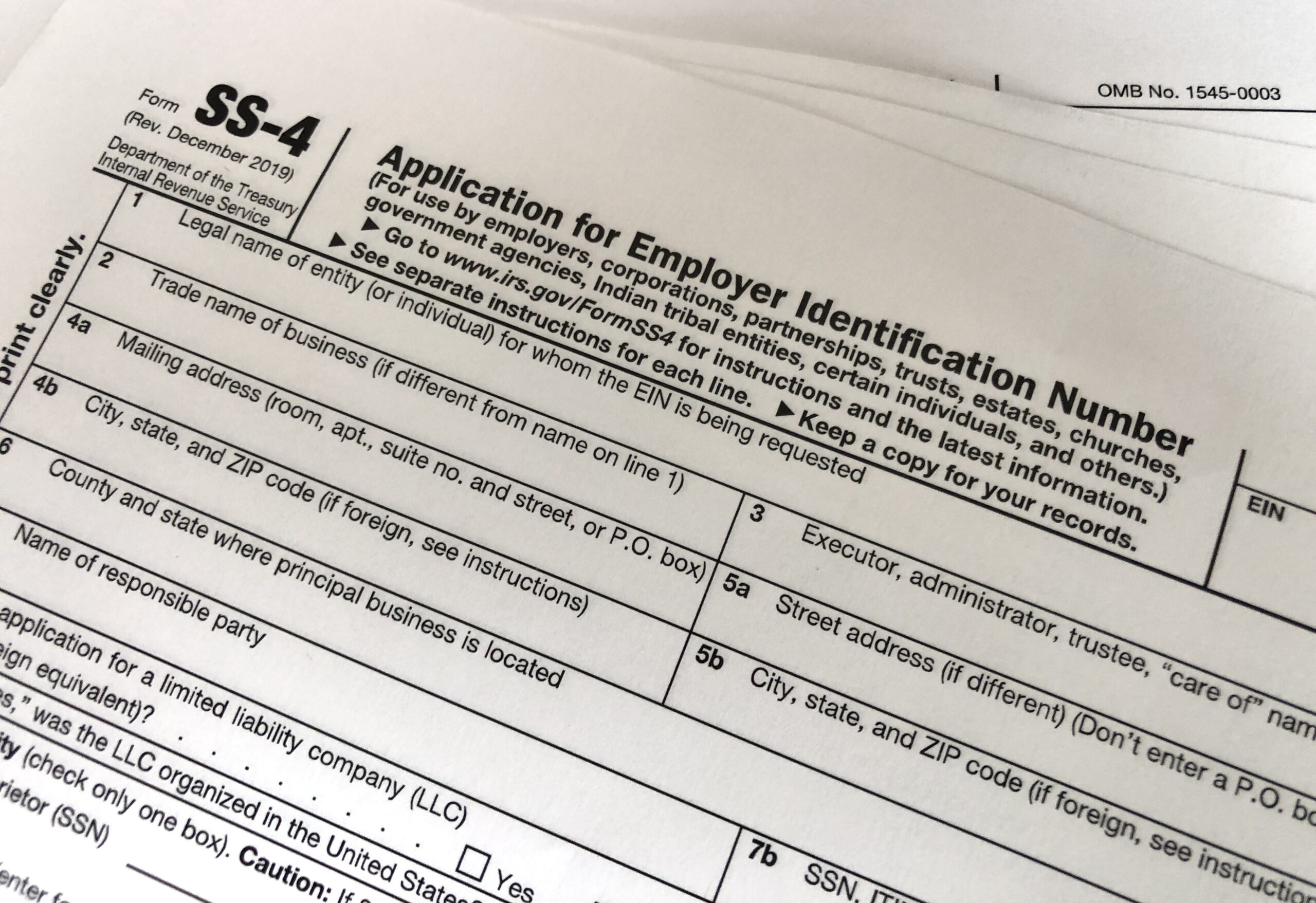

How to Apply for an Employer Identification Number (EIN)?

You first need to ensure you are eligible to apply for one. You can apply by mail, fax, or online. The application process is easy, but there are a few things to remember. You must provide an address, a phone number, and a few other pieces of information to complete the application. You will be asked to fill out some information about your business, but it should be minimal.

It typically takes less than 20 minutes to complete the application online. With the online application, you will have an opportunity to save and return later. You can see the status of your account in real-time. The site is very user-friendly and easy to navigate through. You will need a valid email address, an internet connection, and access to a computer. If applying online is not an option, just complete the form and fax or mail it to the IRS. The employer identification number will be assigned and sent to you within a few business days.

Where to use the EIN?

You will need the number when opening a bank account, applying for a business license, filing taxes, and making other business-related transactions. The bank will ask for the number when you open an account. You must provide it when filing your tax return and any 1099 forms that need to be sent to service providers. It will also be on your pay stubs and other documentation required by the IRS or other governing bodies in your country. The number should be provided in any correspondence regarding your business or taxes.

You will also be required to provide it if you hire a care provider for your child or another family member. This can range from a full-time nanny or house manager to an occasional babysitter or house cleaner. If you take care of your parents or do favors for friends and family members, this does not require a number.

What are the benefits of getting an EIN?

The employer identification number is one of the first steps you should take if you are serious about starting a business. It will provide a streamlined process and simple bookkeeping and help protect your business.

1. Prevent Identity Theft

The number allows you to separate personal finances from business finances. This is a great way to protect your customers’ and employees’ personally identifiable information. You can track personal and business funds as they flow in and out of your business. This can help prevent identity theft, a massive problem for businesses due to spreadsheets, tax records, and other financial documents that are lost or stolen and may lead to the misuse of personal information.

2. Business Taxes

This number allows you to file your taxes by matching the numbers you have with the IRS’ definitions of your organization. When an EIN is optional, duplicating information such as social security number can result in a delay in processing and mistakes during tax season. The number can also be used to establish a company’s tax status. This helps to determine how much taxes should be paid on receipts and profits.

3. Establishing Business Credit

This number will be used for all financial transactions. If you do not have an identification number, obtaining business credit and loans is difficult. Credit checks can also be delayed by a few days. The number allows firms to receive financial assistance from banks, other companies, and the government. The number also helps to establish a credit history. An excellent credit rating is essential for securing business loans.

4. Compliance with Regulations

The employer identification number is one of the most basic requirements of any business, as this number must be filed on all tax forms, products, and procedures. Non-compliance with IRS regulations and other government agencies will result in penalties. The number also connects all corporate accounts with your IRS records so that you receive timely and accurate amounts.

5. Business Finances

When you have an identification number, it is easier to integrate business finances and manage business accounts. Finding where the money came from and where it is going is much easier. This can help you get an idea of how profitable your business is, as well as prevent overspending on goods or services. Your finance department can track the money flow and ensure it’s not going down a hole. If you ever worry about where every last penny goes, an EIN will help you.

6. Helps Build Trust With Vendors

An employer identification number is an excellent way to establish trust with a vendor. It tells them that you are regulated and legitimate, especially if you have little or no history to go off of. To build trust, apply for all the correct permits, licenses, and numbers. It gives people peace of mind that you are following the rules. Otherwise, your vendor will be worried and likely refuse to do business with you.

7. It Aids in the Formation of a Corporate Entity

This number helps to create a corporate entity that separates personal liability from corporate liabilities. This is essential for people who want to avoid legal problems and protect their personal assets. If a company screws up, the burden should fall on the company, not on a person’s assets. This gives people more freedom in setting up and running their businesses.

8. Professionalism

Professionalism is all about consistency and good business practices. This is one of the main reasons a small business has an identification number. This shows that you are running your business legally and professionally. If a company is not up-to-date with its taxes, it is evident they aren’t taking care of itself. You want to ensure that everything you do has attention to detail because it makes you look more professional and organized.

9. Business Invoicing

When you have an identification number, you can simplify things by using it on all your business invoices. This helps to make invoices easier to read and understand. Matching an invoice with the correct product or service is also easier. If a vendor wants a signed and completed IRS W9 Form, you only need to give them your EIN and sign your name. You can use this as an invoice number for multiple purchases or services.

An employer identification number is definitely something that you should consider getting if you are starting a business. It will help simplify your books and taxes and keep your business records in one location. It makes you look professional and shows your customers and vendors that you are a legitimate business.